Federal Budget update

Federal Treasurer, Wayne Swan recently handed down the Federal Budget for 2011 – 2012. This summary outlines the key changes that may impact your own household budget.

It is important to remember that the items covered in this article are proposals, and will only come into effect once legislation has been enacted.

1. Proposed superannuation changes

Phasing out of the pension drawdown relief

Minimum payment amounts for account‑based, allocated and term allocated pensions will be reduced by 25% for 2011‑12.

The standard payment amounts will apply from 1 July, 2012.

Refund of excess concessional contributions

The Government will provide eligible individuals with the option to have excess concessional contributions taken out of their superannuation fund and assessed as income at their marginal rate of tax, rather than incurring excess contributions tax.

This measure will apply where an individual has made excess concessional contributions of up to $10,000 (not indexed) in a particular year. If legislated, this option will only be available for the first excess contribution in 2011-12 or later years.

Higher concessional superannuation caps for over 50s

Retention of the higher concessional contributions cap for individuals aged 50 and over from 1 July 2012, will only apply to those with total superannuation balances of less than $500,000.

Increase in Self Managed Superannuation Fund (SMSF) levy and introduction of SMSF auditor registration fees

To fund a range of Stronger Super SMSF measures, the Government is proposing to increase the SMSF levy from $150 to $180, effective from the 2010‑11 income year. SMSF auditor registration fees will also be introduced from 1 July 2012.

2. Social security and family benefits

Age Pension

From 1 July 2011, Age pensioners who work will be able to earn $250 per fortnight above the income-free limit, before their pension is affected under the income test.

Under the current Work Bonus rules, only 50% of the eligible employment income is disregarded in the income test, up to the maximum of $250 per fortnight.

Family tax benefit payments

The following measures are proposed to the rules regarding Family Tax Benefits (FTB):

- From 1 January 2012, the maximum rate of FTB (Part A) for 16-17 year olds in secondary school, will be increased by $4,208, and for 18-19 year olds in school by $3,741 per year.

- From 1 July 2011, eligible families will be able to receive an advanced payment for $1,000 of FTB Part A.

- From 1 January 2012, the dependant child’s maximum age for eligibility of FTB will be lowered from 24 to 21.

- FTB (Part A) lower income threshold (currently $45,114) and the FTB (Part B) secondary earner income threshold (currently $4,745) will continue to be indexed.

Freeze on certain income limits

Certain income limits will be frozen on a number of payments until 30 June 2014, specifically:

- FTB (Part B) primary earner income limit will remain at $150,000

- Baby Bonus eligibility limit will remain at $75,000 family income, in the 6 months following the birth or adoption of the child

- Paid parental leave income limit will stay at $150,000 for the primary carer in the previous financial year, before the birth or adoption of the child.

Disability Support Pension (DSP)

- Under the current rules, individuals granted DSP on or after 11 May 2005, cannot work more than 15 hours a week. From 1 July 2012, DSP recipients will be allowed to work up to 30 hours a week without their payment being cancelled or suspended.

Youth Allowance & Newstart Allowance (NSA)

- From 1 July 2012, both the eligibility and the parental means test for youth allowance recipients will be extended to 21 years of age (currently 20 years of age).

- Newstart Allowance will be closed to new applicants under 22 years of age (currently under 21 years of age).

- From 1 January 2013, single principal carers receiving NSA who are caring for a child under 16 will have a more generous income test. The new income test will reduce NSA by 40 cents for every $1 dollar of income above $62 per fortnight.

- Income free limit for Youth Allowance will increase from $62 per fortnight, to $143 per fortnight.

- Working Credit bank limit for Youth Allowance will increase from $1,000 to $3,500.

Paid paternity leave for fathers

Implementation of paid paternity leave will be deferred by 6 months from 1 July 2012, until 1 January 2013.

When operational, the measure will provide eligible working fathers and other partners who are providing full-time care or sharing a child’s care, with 2 weeks of paid paternity leave. The leave will be provided at a rate equivalent to the national minimum wage (currently $570 per week before tax) for children born on or after 1 January 2013.

3. Taxation

Personal tax measures

Removing minors' eligibility for low income tax offset on unearned income

The Government will remove access to the Low Income Tax Offset (LITO) for unearned income of minors, effective from 1 July 2011.

The measure will discourage high income earners allocating their income to children under 18 years of age. The removal of this access to LITO will only impact unearned income such as dividends, interest, rent, royalties, income from property and trust distribution to minors.

Children under 18 will continue to be able to use the LITO to reduce income tax on their employment income. Unearned income of minors who are orphans or disabled, as well as compensation payments and inheritances received by minors, will not be affected by this measure.

Phasing out of dependent spouse offset

The dependent spouse tax offset is proposed to be phased out for taxpayers with a dependent spouse born on or after 1 July 1971. This measure is set to eliminate one of the barriers to workforce participation by gradually removing the tax concession for taxpayers with a non‑working spouse and no children.

Taxpayers with an invalid or permanently disabled spouse, supporting a carer, or people who are eligible for the zone, overseas forces and overseas civilian tax offsets will not be affected by this change.

Increasing the Medicare levy low-income thresholds

With retrospective effect from 1 July 2010, the Medicare levy low-income thresholds will increase to $18,839 for individuals and $31,789 for families.

The additional amount of threshold for each dependent child or student will also increase to $2,919.

Also effective from 1 July 2010, the Medicare levy threshold for single pensioners below Age Pension age will increase to $30,439.

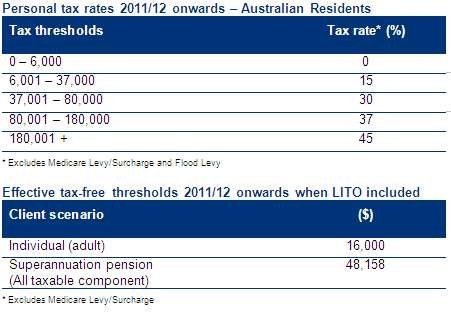

No changes to personal tax rates

Medicare levy surcharge thresholds for 2011/12

For the 2011/12 income tax year, the income tax thresholds will be:

- $80,000 single surcharge threshold

- $160,000 family surcharge threshold (increases by $1,500 for each dependant child after the first)

Additional expenses eligible for Education Tax Refund

The Education Tax Refund entitles eligible parents, carers, legal guardians and independent students to a tax refund upon incurring certain expenses. Currently, these expenses include computers, educational software, textbooks and other items. The Government is proposing to extend the definition of eligible expenses to include school uniforms. This measure will apply from 1 July 2011.

Small business/business owner measures

Abolishing the Entrepreneurs' Tax Offset

The Entrepreneurs’ Tax Offset will be abolished with effect from the 2012‑13 income year.

Accelerated initial depreciation deduction for motor vehicles

Small businesses will be allowed to claim up to $5,000 as an immediate deduction for motor vehicles acquired from the 2012‑13 income year. The remainder of the motor vehicle value will be pooled in the general small business pool (depreciated at 15% in the first year and then 30% in later years.

Capital gains tax — amendments to the small business concessions

A number of changes will be made to the small business CGT concessions to ensure they operate as intended. For example, rules effective immediately will be introduced so trusts will, in certain additional circumstances, be treated as connected with other entities.

Other changes will assist in establishing the ‘significant individual’ requirement in circumstances where shares in a company are held jointly by taxpayers and where a discretionary trust has not made a distribution in an income year because the trust had a tax loss or no net income for that year.

Want more information?

For more information on the Government’s Federal Budget proposals please visit amp.com.au and click on the ‘2011 – 2012 Federal Budget Update’ link. Alternatively, please call us today.

What you need to know

The information in this Budget update is provided by AMP Life Limited ABN 84 079 300 379 and is believed to be accurate and reliable as at 11 May 2011. It is of a general nature only and does not take into account your objectives, financial situation or needs. Please consider the appropriateness of the information in light of your personal circumstances. No reader should act on the basis of this article without obtaining specific professional advice. Further details are available from your planner or AMP Financial Planning Pty Limited, telephone 1300 157 173. AMP Life is not responsible for any errors or omissions.